Introduction

One of the most dynamic areas of digital signage today remains digital menus and advertising offers broadcast via remotely controlled displays. The year 2025 was a turning point: the rapid growth of artificial intelligence technologies, virtual avatars, robotic systems, smart displays, and digital signage has radically changed the industry. The scale of these changes is impressive, and their impact on the advertising market can no longer be denied: Yes, these technologies are changing everything..

Digital signage is no longer just a tool for displaying advertisements—it has become a means of personalized, sustainable, and interactive communication. The development of display technologies—4K, 8K, OLED, MicroLED—as well as the introduction of artificial intelligence, cloud platforms, and IoT are contributing to the rapid growth of the entire digital signage market.

Overview of key innovations and trends in the field of digital signage worldwide

Artificial intelligence (AI) and content personalization

Artificial intelligence-based systems analyze demographic data, audience behavior, traffic, time of day, and many other factors, automatically adapting content to the current context. AI is already becoming the centerpiece of digital signage, and by 2026, more than 60% of systems will create personalized messages for specific viewers—from changing ads depending on the time of day to adapting content to the age and profile of the audience.

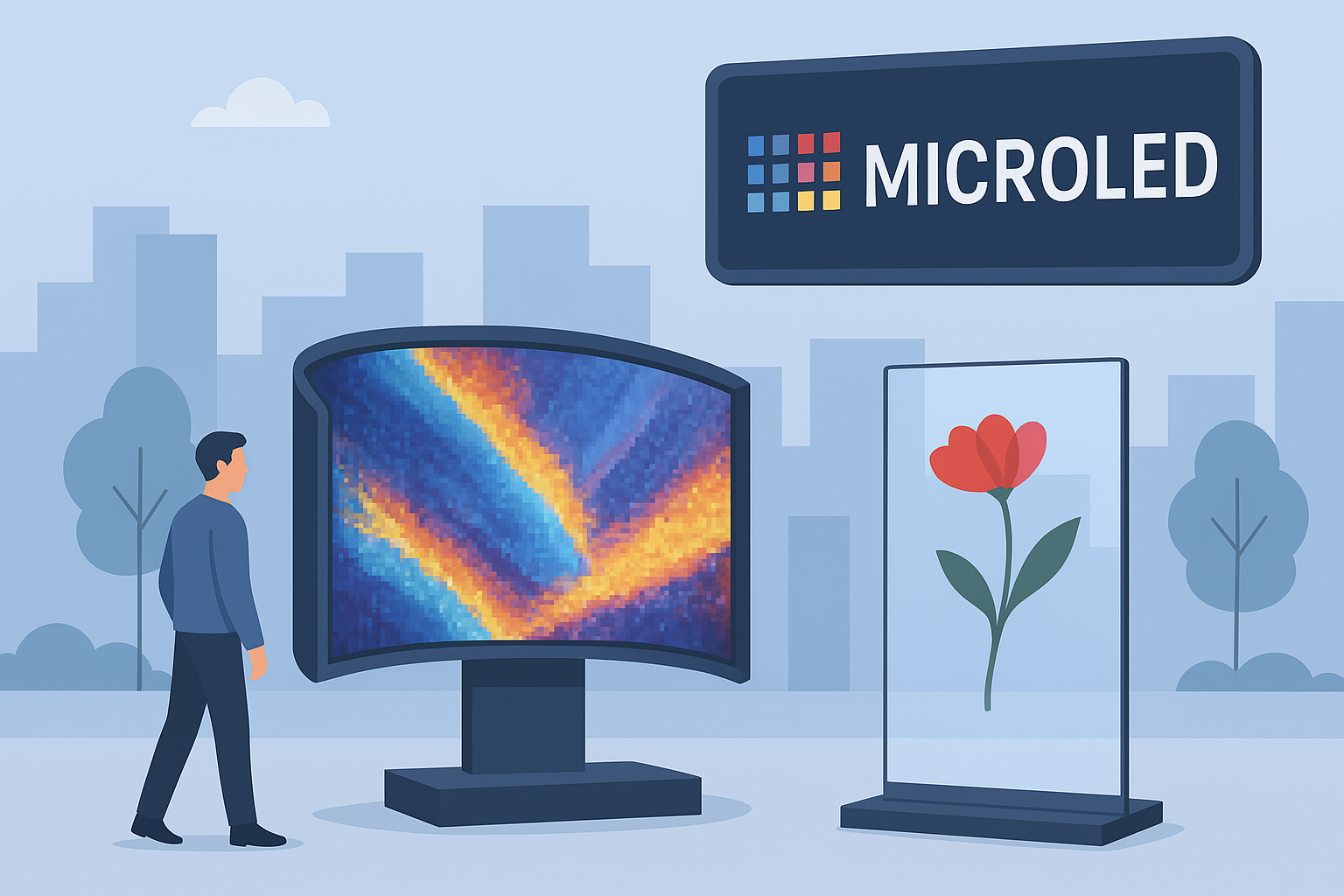

MicroLED and next-generation display technologies

MicroLED technology is setting a new standard of quality in the visual industry. Ultra-small pixel pitch, high brightness, and rich color reproduction make these displays ideal for premium digital signage. Transparent OLED panels, curved displays, and stretchable screens are gaining popularity thanks to their pronounced immersive effect—they literally create a new visual environment.

|  |

|---|---|

| AI-powered content personalization | MicroLED and the displays of the future |

Eco-friendly technology: electronic paper displays

The trend toward environmental friendliness is becoming key. Energy-efficient LED displays and smart signs with automatic brightness control reduce energy consumption. Full-color electronic paper displays are being actively introduced in retail and transportation: they consume virtually no energy in static mode and provide excellent readability even in bright light.

Cross-platform compatibility and integration of AR/VR and 3D

Digital signage is becoming part of augmented reality. AR integration allows customers to “try on” a product or see how it looks in a real environment. VR solutions create a sense of presence. Cross-platform compatibility ensures that digital signage works in a single ecosystem with different systems and devices.

|  |

|---|---|

| Eco-friendly electronic paper displays | AR/VR and 3D integration |

Interactivity and contactless interfaces

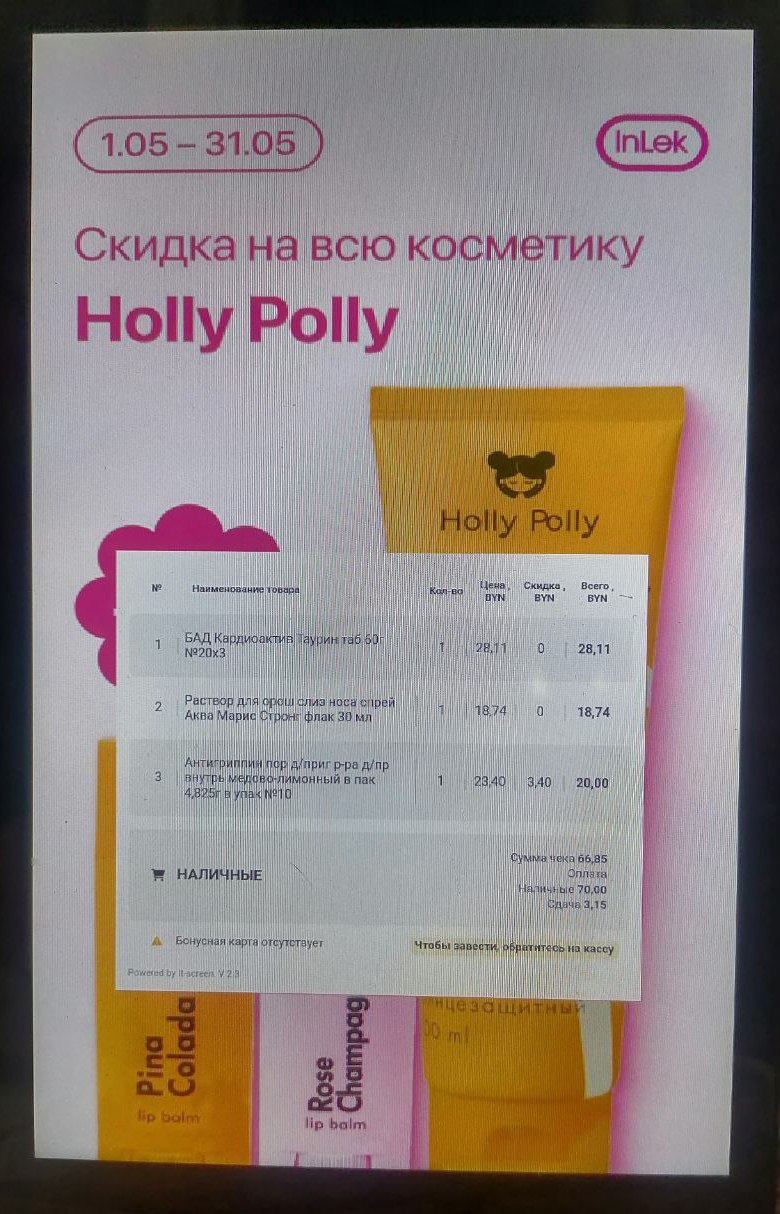

Touch interaction, gesture control, voice commands, and mobile interfaces via QR/NFC are becoming the norm. Interactive digital panels with AI prompts are changing the user experience: kiosks can offer products, respond to visitor actions, and adapt display scenarios in real time.

Advanced accessibility features

Accessibility is becoming a mandatory standard. Modern digital signage includes high-contrast modes, large fonts, voice navigation, and sign language avatars. This makes digital screens accessible to a wide range of users, including people with disabilities.

|  |

|---|---|

| Interactive Contactless Interfaces | Inclusive digital signage |

Real-time multilingual translation

AI translators enable instant adaptation of content to audiences in different countries. In airports, hotels, and multifunctional centers, such systems facilitate convenient interaction with a global flow of visitors.

Integration with IoT devices and smart systems

Modern displays interact with IoT devices and transmit data in real time. They synchronize with smart city systems, serve as a channel for notifications, and are used in smart home architecture: lighting, climate control, security, motion sensors—everything is combined into a single infrastructure.

|  |

|---|---|

| Real-time Multilingual Translation | IoT integration in digital screens |

Analytics, data, and programmatic advertising (DOOH)

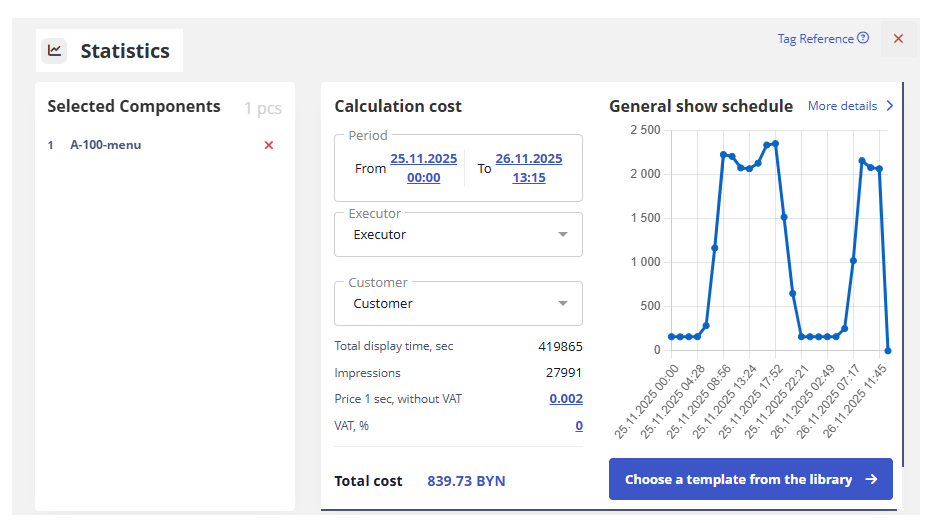

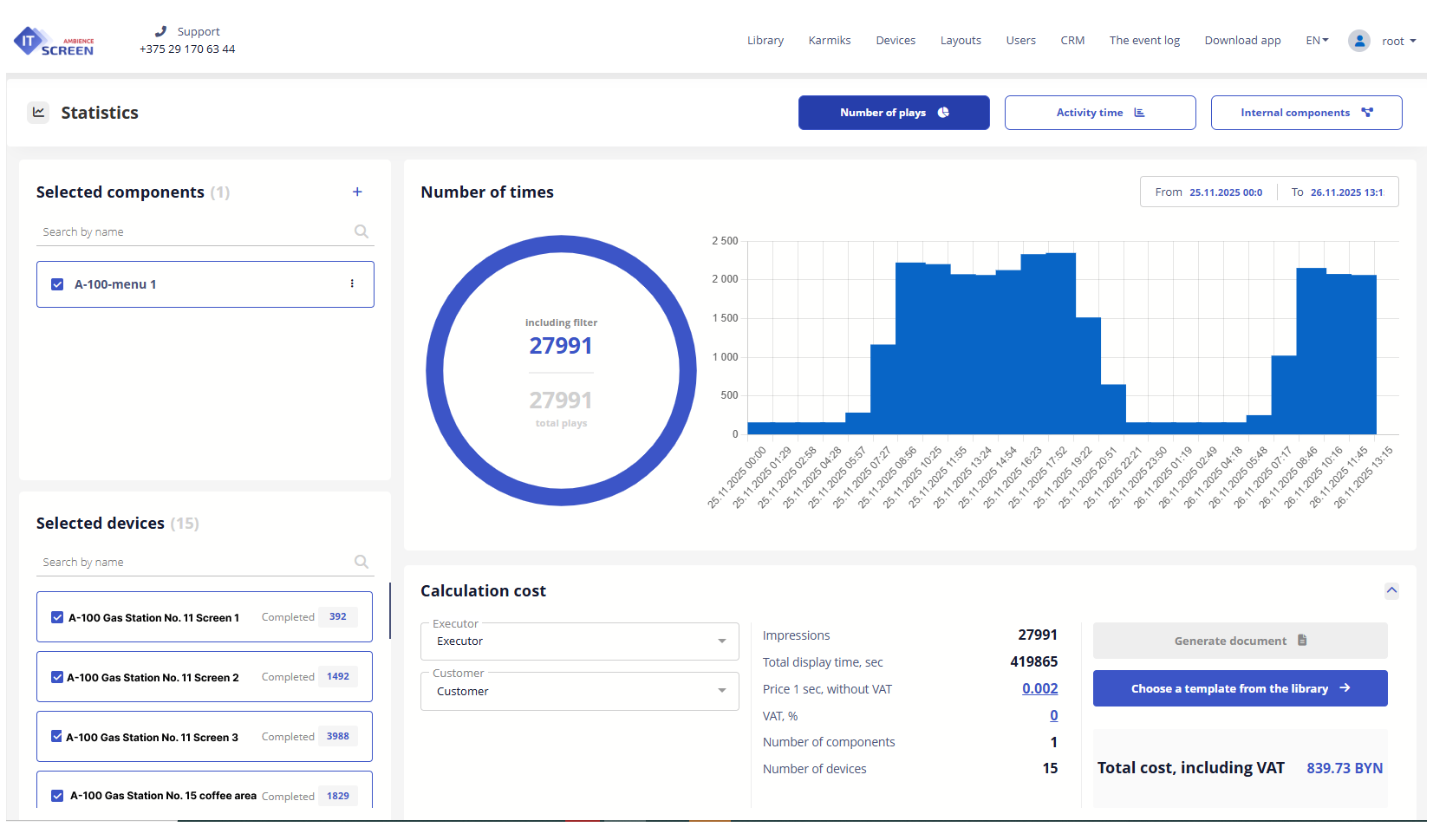

Digital signage is becoming a fully-fledged analytical tool. Modern displays record the number of viewers, depth of engagement, attention span, interaction, and behavioral patterns—the ways in which people behave and react to certain situations. Advertisers use this data to evaluate the effectiveness of their campaigns.

Programmatic DOOH—an automated algorithmic approach to ad placement—uses data on weather, traffic, time of day, and demographics to display the most relevant content at any given moment. This transforms digital signage into a dynamic media platform with flexible adaptation.

Integration with social networks

The combination of digital signage and social media is becoming one of the most powerful engagement tools. Research shows that broadcasting live streams and user-generated content on digital screens increases audience attention by 70%. Brands integrate Instagram, X/Twitter, YouTube, and TikTok feeds, creating a lively bridge between the physical and digital environments.

|  |

|---|---|

| Programmatic DOOH analytics | Integration with social media |

Cloud management and scalability (cloud CMS)

The transition to cloud-based content management systems (CMS) has become the new industry standard. These systems enable centralized management of thousands of screens, instant content updates, schedule creation, synchronization of changes, and equipment status monitoring.

Cloud solutions are particularly relevant for network businesses with branches in different cities or countries. Not having a cloud CMS today effectively means falling behind technologically.

Enhanced cybersecurity measures

The growth in the number of connected digital screens inevitably increases information risks. Modern companies are implementing encryption, multi-factor authentication, network segmentation, intrusion detection systems, and AI activity monitoring.

Secure cloud infrastructure is becoming a critical part of the digital ecosystem, reducing the risk of hacking, content tampering, and privacy breaches.

|  |

|---|---|

| Cloud-based Digital Signage Management | Cybersecurity of Digital Signage |

New digital signage technologies to watch out for

If we look ahead to the future after 2025, we can see that several new technologies have the potential to significantly change the digital signage market.

Holographic displays

Holographic AI assistants and 3D content are currently undergoing rapid development. It is expected that in the coming years, these technologies will become more realistic and accessible, allowing companies to implement futuristic scenarios for interacting with their audiences.

Companies are already showcasing holographic solutions at international exhibitions, using them as a tool to create a visual WOW effect and attract customers.

Integration with Meta Universe

With the development of meta universes, digital signage is becoming a bridge between physical and virtual reality. Displays can broadcast immersive content related to virtual events, objects, and worlds, extending the user experience far beyond conventional screens.

China: Innovative Technologies in Digital Signage

In 2025, China maintained its status as the global leader in digital signage, demonstrating rapid market growth and technological maturity. The government initiatives “Digital China” and “Smart City” are stimulating the development of the industry, which is actively integrating with artificial intelligence, IoT, and 5G/6G technologies.

The rapid growth of domestic and international tourism and the hosting of international events are creating huge demand for intelligent display systems, from navigation panels to interactive media installations.

SIGN CHINA 2026 Spring Edition

Shenzhen will become the epicenter of global innovation in digital signage in early 2026. Here, in the host city of the APEC 2026 (Asia-Pacific Economic Cooperation) summit, the SIGN CHINA 2026 Spring Edition exhibition will be held from March 1 to 3. Over the past 16 years, it has gained recognition as a global platform for professionals in the field of signage, printing, and digital displays, attracting participants from more than 100 countries every year.

LED CHINA Exhibition

Founded in 2005, LED CHINA is the oldest and one of the largest global exhibitions dedicated to LED technologies. For more than 16 years, it has attracted participants from hundreds of countries and remains an important benchmark for the LED display, signage, and audiovisual solutions industry.

In 2026, LED CHINA will continue its dual-session strategy: spring in Shenzhen and autumn in Shanghai. It will combine its venues with PALS Asia, Digital Signage China, and SIGN CHINA exhibitions, bringing together the expertise and resources of related industries to share innovations.

Main technological trends at exhibitions and their participants

LED Lightbox Series

Presented by TIANYU EXHIBITION EQUIPMENT & MATERIALS CO., LTD

TIANYU specializes in equipment for exhibitions, advertising, and retail. Their LED lightboxes are distinguished by high brightness, uniform illumination, and extensive customization options. These designs are used to illuminate advertising posters, decorate stands, shop windows, and brand zones.

|  |

|---|---|

| Series of LED lightboxes | Lightbox at the bus station |

Key innovative advantages:

• AI content optimization. Built-in analytics systems based on computer vision allow you to automatically adjust the visuals displayed to suit the audience, time of day, and weather.

• Uniform illumination. LED strips and diffusers provide stable lighting across the entire area.

• Energy efficiency. LED technologies enable significant reductions in energy consumption..

• Long service life. LEDs are designed to operate for tens of thousands of hours without degradation in brightness.

Inflatable Display Set

Presented by CHANGZHOU MAI KAI SI WEI PRCISION MACHINERY CO., LTD

The company specializes in the production of new-generation inflatable advertising structures. Their products are mobile digital installations that combine an inflatable frame with a built-in LED or LCD screen.

|  |

|---|

Inflatable Display Set

Purpose: rapid deployment of digital content in high-traffic locations—at festivals, city events, sports arenas, fairs, and off-site presentations.

Key innovative advantages:

• Maximum mobility. Unlike traditional LED stands, inflatable screens do not require metal structures or heavy equipment. This is a “digital signage to-go” format.

• Energy efficiency. Lightweight housing reduces the need for additional infrastructure; options with autonomous power supply are available.

• Minimal logistics. One person can unfold the structure in a matter of minutes..

• Interactivity. They can be equipped with touch screens, motion sensors, Bluetooth modules, and QR interactives. This makes the design a digital communication center, not just a screen.

• Attractive appearance. The voluminous, soft, and futuristic shape enhances the audience's attention.

• Safety. A soft frame reduces the risk of injury in public spaces.

Large 3D screen with LEDs

Presented by LED CHINA and EnBon Group

LED CHINA is the initiator of international exhibitions in the field of LED technology. EnBon Group is a high-tech company from Shenzhen (founded in 2009) specializing in the development and production (R&D research and development) of large LED displays.

|  |

|---|---|

| Large 3D screen with LEDs - LED CHINA | 3D digital advertising media. Exhibitor: EnBon Group |

|

|---|

| Large 3D screen with LEDs - Shanghai, September 2025 |

Purpose: creating realistic three-dimensional visual effects without VR/AR equipment. Such screens provide the effect of “objects extending beyond the display.”

Key innovative advantages:

• The “naked eye” effect. 3D images can be viewed without additional devices.

• Creating a virtual space. Objects “fly” beyond the boundaries of the screen, creating a sense of presence.

• High pixel density. The use of MicroLED/MiniLED provides detail and color depth.

• Interactivity. Integration with AR, motion sensors, and AI content generation.

• Intelligent energy saving. Automatic brightness control and smart power controllers.

3D hologram projection

Presented by DONGGUAN RUYUAN INTELLIGENT TECHNOLOGY CO., LTD.

The company manufactures holographic fans and projectors (known as “hologram fans/hologram projectors”) designed to create “floating” three-dimensional images in the air — one of the most impressive tools in digital signage. The company markets its products under the COEUS trademark/brand.

|  |

|---|

3D hologram projection

Purpose: Demonstration of three-dimensional visual objects that appear to float in the air. Ideal for retail, exhibitions, and presentations.

Key innovative advantages:

• The “floating” effect. The image looks like a real object floating in the air.

• Complex 3D animations. Disassembly of objects, rotation, transformations, visualization of mechanisms.

• Compactness. Installation takes 5–10 minutes and requires no construction work.

• 360° work. Visibility from all sides.

• High refresh rate. Realistic, stable image.

• Interactivity. Motion response, integration with AR/VR, and AI personalization.

• Viral effect. People eagerly take holograms and share them on social media.

• Low energy consumption. Significantly lower than that of large LED screens.

• Scalability. Several devices can be combined into a single holographic wall.

LED film screen

Presented by companies - GUANGDONG LEIYI OPTOELECTRONICS TECHNOLOGY CO., LTD, NAR INDUSTRIAL, UHLED TECHNOLOGY

LED film is one of the most impressive trends in digital signage. It is applied directly to glass surfaces and transforms shop windows, partitions, and facades into transparent multimedia screens.

• GUANGDONG LEIYI — manufacturer of transparent and flexible LED panels.

• NAR Industrial — world leader in the production of high-tech films.

• UHLED — manufacturer of transparent facade LED screens.

|  |

|---|

LED film screen

|  |

|---|---|

| Wall sticker made of material. Exhibitor: NAR INDUSTRIAL | Transparent screen. Exhibitor: UHLED TECHNOLOGY |

Purpose: transforming glass surfaces into multimedia translucent screens. Used in retail, architecture, offices, exhibitions, and media displays.

Key innovative advantages:

• Thickness 1–3 mm. Virtually invisible on glass.

• Up to 90% transparency. Does not conceal the interior and goods.

• Quick installation without frames or fasteners. The film is applied directly onto the glass.

• Flexibility. The film easily conforms to complex surfaces: cylinders, waves, smooth curves.

• Modularity. Supports HD/4K formats and scales to large areas.

• Energy efficiency. Consumes 40–70% less power than traditional LED screens.

• Integration with content management systems. Full support for schedules, synchronization, remote control.

• The “invisible screen” effect. When switched off, the glass remains transparent. Ideal for “hidden advertising.”

China: Digital Signage and System Integration

Smart transportation

Absen — OXO City/Shanghai Hongqiao (airport + transportation hub)

One of China's largest LED installations has been implemented at the OXO City transport hub, which connects Hongqiao Airport and the railway station of the same name. The total area of the screens is approximately 1,800 m². These are video walls, volumetric LED cubes, and panoramic displays, visible to hundreds of thousands of passengers every day.

|

|---|

| Absen — OXO City/Shanghai Hongqiao |

Integration with smart transportation:

The displays operate as part of the transport information system. They show timetables, routes, transfers, flight statuses, and emergency notifications. The system receives data from passenger flow management platforms across the entire China Railway (CR) network. This allows content to be dynamically updated in real time—for example, in the event of a train delay or platform congestion.

Video surveillance + Digital Signage

Производители: Hikvision, Dahua

Major Chinese video surveillance system manufacturers are creating integrated solutions for public transport that combine cameras, media players, on-board displays, and cloud-based management platforms (MPS). Dahua is a partner in the digital signage industry, while Hikvision provides solutions for public transport and stops.

|

|---|

| Video surveillance system manufacturers + Digital Signage — integrated solutions for buses/stations |

How it works:

• cameras and sensors transmit data to a central platform;

• the system analyzes passenger traffic;

• based on the data, the content at bus stops, on buses, and at stations changes automatically;

• In the event of incidents, safety notifications are sent, routes are adjusted, and signals are sent to drivers.

Innovative advantages:

• single chain: “analytics → cloud server → digital scoreboards”;

• real-time adaptation of routes and recommendations;

• improved safety;

• reduction in workload for staff;

• the ability to centrally update content and software.

Integration of Digital Signage in CRH/CR high-speed trains

The following digital signage system can be found in standard carriages on Chinese high-speed trains (CRH/CR series): - a centralized on-board content management system (CMS) with a local server for each train, which manages the advertising schedule and is integrated with the Multifunction Vehicle Bus (MVB) train data system, from which it receives information about the current speed, next station, estimated time of arrival, current time, and train location via the GPS/Beidou system, as well as important information from the dispatcher.

|  |

|---|

**Photo of the interior of a high-speed train carriage on the Luoyang-Xi'an route using an integrated system based on Digital Signage.**

How this integrates with smart transportation:

• When the train enters a new line, the route is loaded automatically.

• The system synchronizes with regional CR centers (e.g., Xi'an Group, Zhengzhou Group).

• When routes change or delays occur, screens instantly update their content.

• Data on transfers, subways, and alternative trips are displayed;

• Integration with onboard IoT devices and video cameras has been implemented: via car load sensors → recommendations for seating can be displayed in the app, video cameras → provide safety notifications, onboard data → display various information, including warnings.

Smart home

Xiaomi — Mi Home + wall-mounted smart panels

Xiaomi is developing a unified smart home ecosystem, where Digital Signage acts as the central control panel. Wall-mounted displays connect via Wi-Fi, Zigbee, and Bluetooth, displaying the status of IoT devices, notifications, video calls, and service advertisements.

Advantages:

• single device management platform;

• script automation;

• integration with cloud CMS;

• mass availability and low implementation threshold.

Haier — U+ Smart Home / experience centers with Digital Signage for the smart home

Haier is developing the U+ ecosystem, where large touch panels are used in kitchens, living rooms, lobbies, and entrance halls. They display notifications from government authorities, advertisements from partners, the status of household appliances (refrigerators, microwaves, air conditioners), and messages from the management company. The system is used in large residential complexes.

|

|---|

| Haier — U+ Smart Home/experience centers с Digital Signage |

Advantages:

• deep integration with household devices;

• a single channel of communication with residents;

• centralized CMS;

• using touchscreen displays as a home interface.

Huawei — HiLink / IdeaHub and B2B solutions (home management, hotels)

Huawei is developing its HiLink service and large interactive IdeaHub displays; in the residential and hotel segment, these screens are used as digital panels in lobbies, concierge service rooms, and apartments (for management and communication with the management company). Huawei positions its displays as corporate/residential gateways integrated with the cloud and HiLink service..

|

|---|

| Information monitor at the Ocean Hotel (Shanghai) with personalized content |

Innovations:

• secure corporate infrastructure;

• integration with HiLink IoT;

• video streaming;

• personalized content for guests.

Culture and tourism

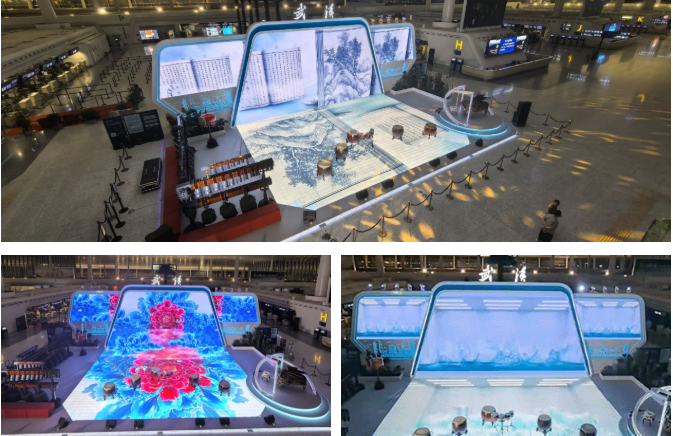

Wuhan: Installation “Love at First Bell”

An installation called “Love at First Bell” has been set up at Wuhan Tianhe Airport, using both wall-mounted and floor-mounted LED screens. The installation promotes cultural tourism in China through immersive storytelling. .

|

|---|

| Love at first ring of the bell |

The interactive LED floor transforms every step into a scene from Chu culture, inspiring travelers to stop and learn about Chinese history. Combined with a giant HDR LED screen and 3D visual effects, the installation brings ancient music, murals, and heritage to life, transforming the airport space into a vibrant cultural space.

Shanghai: Shanghai Tower

The Shanghai Tower is an example of how digital signage can be integrated into a city brand, tourist navigation, and cultural space. The building uses multilingual interactive panels, LED installations, and content about the history and culture of Shanghai.

|  |

|---|

|  |

|---|

The Shanghai Tower is a prime example of how digital signage can be integrated into the tourist experience, city branding, and cultural space.

Digital navigation is widely used in managing tourist flows: priority boarding in elevators, floor loading, routes to cultural areas.

Xi'an: Terracotta Army Museum

The Terracotta Army Museum (Mausoleum of the First Qin Emperor) — is a large-scale archaeological complex that forms part of the tomb of the first emperor of unified China, Qin Shi Huang (259–210 BC). The museum actively implements digital technologies, transforming itself into an immersive historical complex. It uses AR guidance, transparent OLED panels, panoramic 8K video walls, and AI-based personalization.

Before entering the museum, use the smart information kiosks: multilingual terminals with an interactive map of the complex, tour schedules, and real-time ticket prices. You can print your ticket right away or get a QR code.

|  |

|---|

|  |

|---|

Mausoleum of the First Qin Emperor

Inside the museum complex, there are panoramic LED video walls (8K) and context-dependent transparent OLED screens with dynamic content based on augmented reality (AR) with AR guidance on the visitor's smartphone, content personalization based on AI with language recognition (via RFID in the ticket) with a choice of information delivery layer (children-adults and/or basic → in-depth → expert), creation of individual “stories” based on the length of stay and interests of visitors.

The system provides smart management of the museum environment: real-time AI analysis of visitor flow – dynamic changes to tourist routes, peak load forecasting, lighting synchronization, microclimate monitoring with visualization on displays.

Overall summary of developments in the field of digital signage.

As digital signage evolves, companies must adopt cutting-edge technologies to remain competitive. Artificial intelligence, augmented and virtual reality, cloud computing, and enhanced cybersecurity will define the next generation of digital displays. Real-time data integration, interactivity, and automation will make customer interactions more engaging and effective.

Digital signage is no longer just a means of displaying content, but a powerful communication tool that is changing the way companies interact with their audience. By leveraging these trends, companies can increase engagement, brand awareness, and operational efficiency in an increasingly digital world.

AI-powered content, IoT devices, MicroLED screens, cloud platforms, and immersive technologies are driving unprecedented growth and changing how companies interact with their audiences. The market is expected to grow to $41.41 billion by 2030, so following these trends will be crucial to achieving maximum business impact.

Innovations at MediaStroyImage LLC for 2026

MediaStroyImage LLC is a key partner of It-screen ltd, Cyprus in Belarus. The company provides a full range of services for the implementation and support of cloud solutions for digital signage in the region. The innovative strategy of MediaStroyImage LLC, in collaboration with It-screen ltd, for 2026 and beyond includes both the development of existing capabilities and the introduction of new technological directions that contribute to the transformation of Digital Signage into a full-fledged ecosystem of digital services for business.

Translated with DeepL.com (free version)

Main areas of innovative development

1. Update of the it-screen cloud service. An updated version of the it-screen service is planned for release, focused on stable operation with large amounts of content. Particular attention is paid to database optimization, reducing the load on servers, and improving synchronization algorithms for more than thousands of devices.

Key improvements:

• Accelerated loading of media and schedules;

• new algorithms for calculating analytics;

• improved device group management;

• intelligent self-diagnostics and monitoring;

• API optimization for integration with external systems.

2. Development of a directional sound system. Integration of directional audio into the remote content control service will enable the creation of unique sound zones without overall acoustic load. The system will adapt to the type of content and usage scenario based on intelligent algorithms.

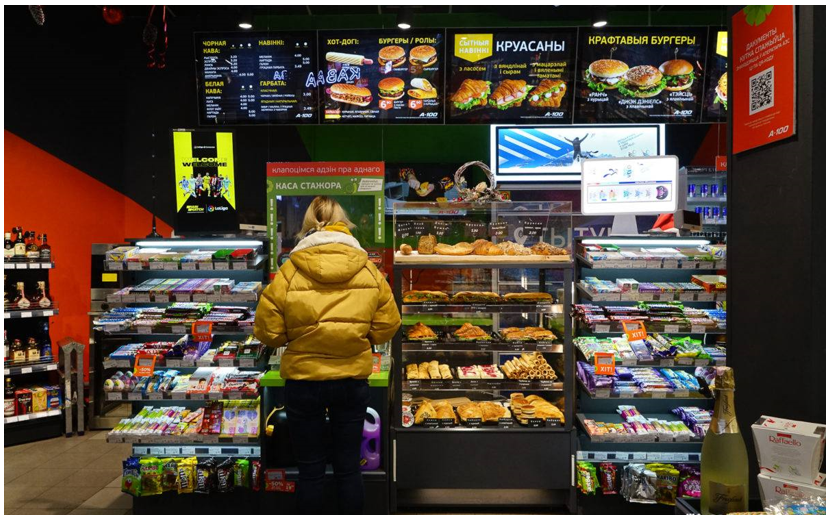

3. Expanding the use of dynamic menus. We plan to deeply integrate dynamic menus with the client's cash register and operating software, which will ensure: • automatic real-time menu updates, • display of current prices, promotions, and stock levels, • reduction of the human factor in content management.

4. Using AI to personalize content. The system will analyze audience behavior, flow, and demographics (in compliance with the legislation of the Republic of Belarus on personal data) to create personalized media scenarios based on neural network processing modules that allow analyzing content effectiveness, determining location traffic, and dynamically adjusting visual materials to the time of day, season, audience, and display context.

Functional updates:

• analysis of videos and images;

• automatic template selection;

• content viewability assessment (Viewability Score);

• automatic testing of layouts before publication;

• generation of visuals for specific scenarios.

5. Application of AR/VR solutions for digital signage. Use of augmented reality technologies for interactive displays: visitors can interact with virtual objects, obtain information about goods or services, and visualize them in a real environment.

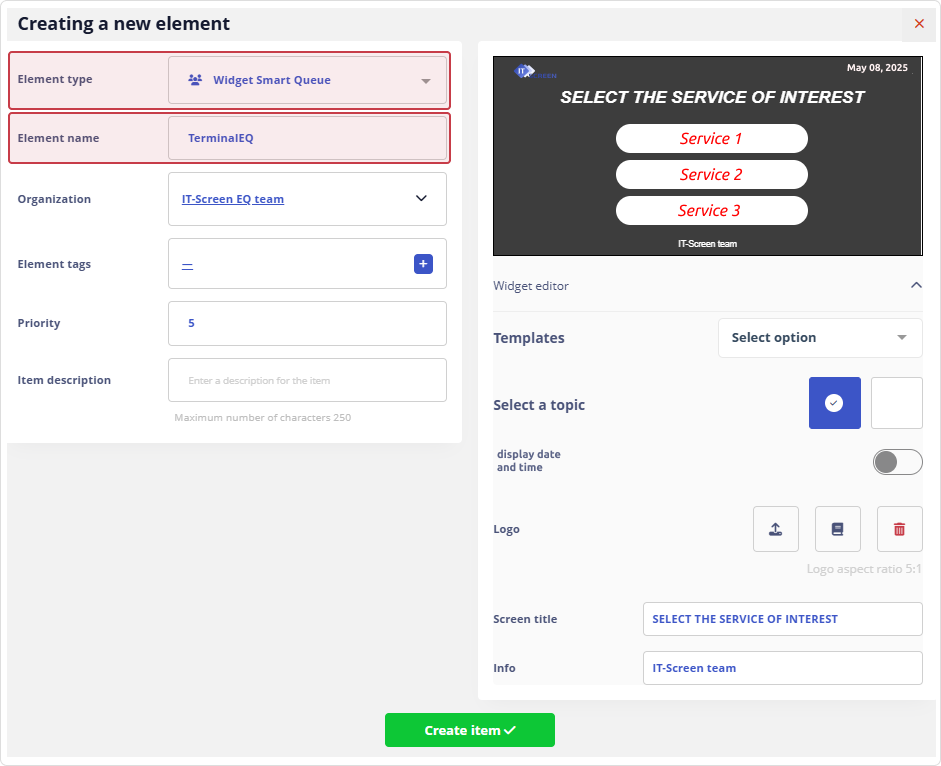

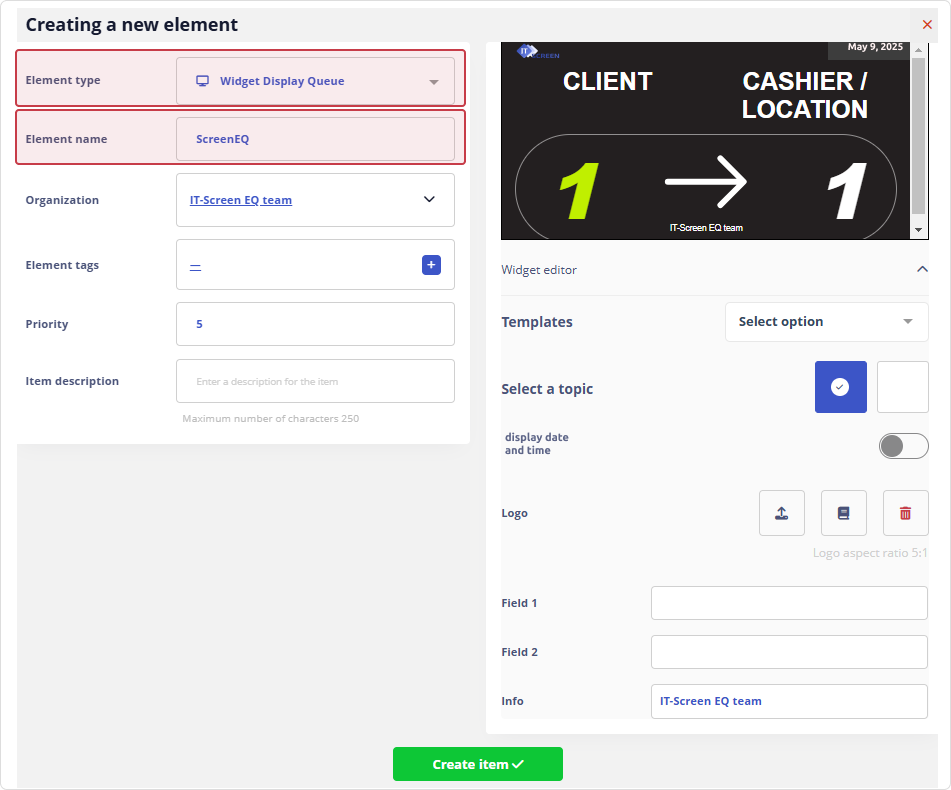

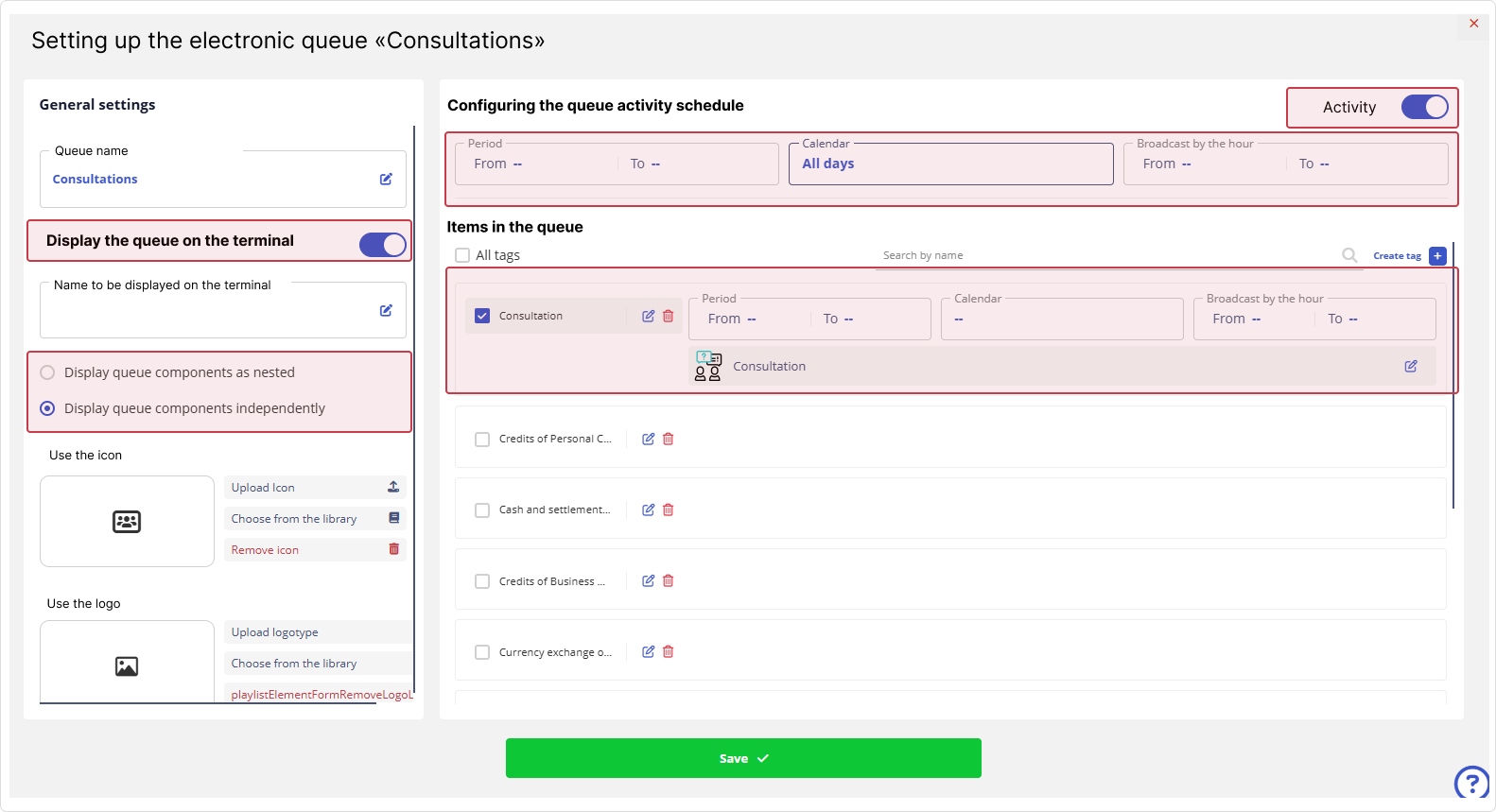

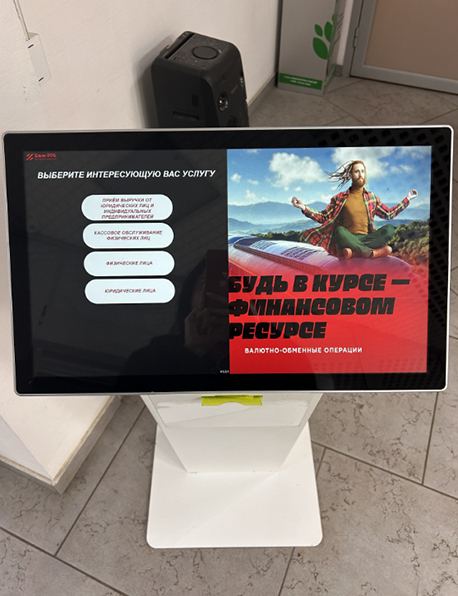

6. Development of electronic queues and integration with Digital Signage. The AI module will enable service load forecasting, optimize waiting times, and automatically display personalized recommendations, notifications, and customer routing.

7. Creating next-generation self-service systems. Terminals and information screens integrated with the it-screen cloud content management platform will provide intelligent information display, support multimodal interaction, and offer adaptive interfaces with any client software.

8. Integration with the client's ERP/CRM systems. The it-screen cloud service will become part of the client's business logic, generating analytics by collecting data on sales of not only advertising, but also goods and services, counting visitors, obtaining heat maps of interest, assessing engagement (dwell time, attention time), and analyzing emotional responses. The analytics will be integrated into the content management system, which will allow for fully automated content updates, making it as relevant as possible.

9. Use of modern, innovative LED panels. Modern LED solutions with high energy efficiency and increased brightness (4K, 8K, OLED, MicroLED) will be used in complexes with a remote content management and IT screen automation system, ensuring high flexibility under any operating conditions.

10. Development of automation and control of IoT devices. The company is expanding the platform's capabilities by connecting motion sensors, CO₂ sensors, climate control systems, and smart lighting. The system will be able to receive data on traffic, weather, time of day, people flows, and emergency situations.

Advantages:

• Dynamic content changes;

• Information routing in emergency situations;

• Integration with heating, climate control, and security systems;

• Display of operational notifications and recommendations.

11.Mobile integration and interaction via smartphone, development of dashboard technology. Organization of interaction via smartphone mobile interfaces, use of dashboard technology to simplify and facilitate the management of content and IoT devices.

12. Strengthening cybersecurity measures. The company plans to expand access control functionality, integrate with corporate security systems, and use modern technologies to protect servers and communication channels.

13. Improvement of service processes. Updated service areas include the introduction of digital documentation, automated equipment testing, QR modules for quick checks, and remote fault diagnosis.

Service improvements:

• digital device cards;

• remote device diagnostics, including IoT;

• automated service reports;

• chatbots for technical support;

• improved knowledge base (https://wiki.it-screen.by/en/).

Conclusion

It-screen ltd is focusing on technologies that will define the market over the next five years: AI, cloud solutions, transparent and flexible displays, VR/AR, and deep integration with smart city infrastructure. These areas form the basis for creating an intelligent media environment that is flexible, adaptive, and user-oriented.

The company will continue to develop innovative solutions, maintaining its leadership in the digital display and media technology market.